Mirwaise khan Achakzai

China’s Belt and Road Initiative (BRI) and the China-Pakistan Economic Corridor (CPEC) have emerged as game-changers for Pakistan’s economic and infrastructural development.

These ambitious projects, driven by extensive Chinese investments, are reshaping Pakistan’s landscape and propelling the nation towards a brighter future. In this article, we will explore the transformative power of BRI and CPEC and their impact on Pakistan.

The China-Pakistan Economic Corridor (CPEC) is a flagship project of the Belt and Road Initiative (BRI) launched by China in 2013. Over the past 10 years, CPEC and BRI have played a significant role in enhancing economic and social cooperation between China and Pakistan.

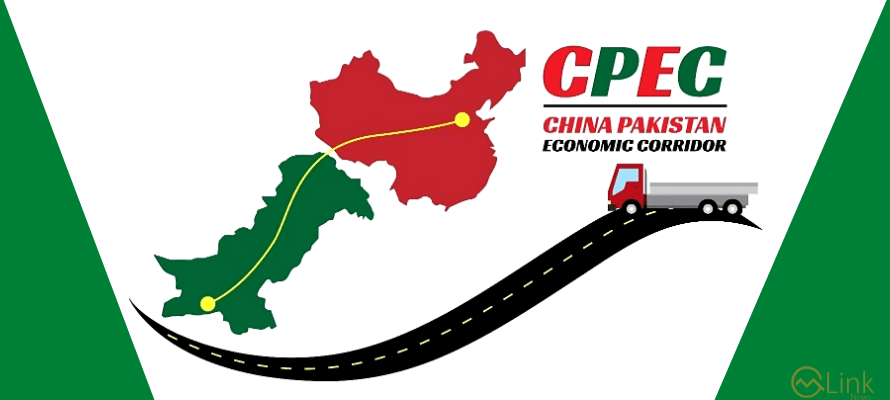

Chinese investments in Pakistan have been significant and have spanned across various sectors. One of the major projects is the China-Pakistan Economic Corridor (CPEC), which is a collection of infrastructure projects worth over $60 billion. It aims to connect Gwadar Port in southwestern Pakistan to China’s northwestern region of Xinjiang, through a network of highways, railways, and pipelines.

In the early harvest projects of CPEC, six mega infrastructure projects were completed including, Havelian-Thakot section of KKH, Multan-Sukkur (M-5) Motorway, Hakla-D.I. Khan Motorway, Optical Fiber Cable, Eastbay Expressway & Orange Line Metro Train.

Gwadar Port:

China has invested heavily in the development of Gwadar Port, located in southwestern Pakistan. The port is a key component of the China-Pakistan Economic Corridor (CPEC) and is being developed as a deep-sea port and free economic zone.

China Overseas Port Holding Company (COPHC) has invested over $1 billion in the port’s development. he country’s deep-sea southwestern port of Gwadar, the centerpiece of CPEC, handled 600,000 tons of cargo in the last 18 months. Necessary facilities of fresh water treatment, water supply and distribution.

Phase-1, lying of pipelines from Swad Dam to Gwadar is completed.

Phase-II laying an additional pipeline from Shadi Khau Dam to Swad Dam is under construction.

Phase-III, Up-gradation of the water distribution system of Gwadar city will be commenced this year

Pak-China Friendship Hospital, groundbreaking held on 16th Dec 2019.

Civil work started by November 2020. Expected Completion date: October 2023

1.2 MGD Desalination Plant

Project Implementation Agreement signed on 5th July 2021. 85% of civil work is completed. China-Aid Gwadar seawater desalination project Mid-term inspection has been completed.

Energy Projects:

Chinese companies have invested in various energy projects in Pakistan, including coal-fired power plants, hydroelectric power plants, and solar energy projects. Notable examples include the Sahiwal Coal Power Project, the Port Qasim Coal Power Project, and the Karot Hydropower Project.

The foremost singular contribution that has already made a significant and visible difference is the addition of 10,000MW to the generation capacity in Pakistan in a span of four years, It has overcome chronic energy shortages, altered the fuel mix, and substituted plants with 61 percent efficiency factor in place of those operating at 28 percent bringing down the cost to consumers.

1320MW China Hub Coal Power Project, Hub Balochistan.

660MW Engro Thar Coal Power Project.

1000MW Quaid-e-Azam Solar Park (Bahawalpur).

50 MW Hydro China Dawood Wind Farm, Gharo, Thatta.

100MW UEP Wind Farm, Jhimpir, Thatta.

50MW Sachal Wind Farm ,Jhimpir, Thatta.

100MW Three Gorges Second and Third Wind Power Project.

Matiari to Lahore ±660 KV HVDC Transmission Line Project.

720MW Karot Hydropower Project, AJK/Punjab.

330MW HUBCO ThalNova Thar Coal Power Project.

1320MW SSRL Thar Coal Block-I 7.8 mtpa & Power Plant (2×660MW) (Shanghai Electric).

Infrastructure Development:

China is investing in the construction of roads, railways, and other infrastructure projects in Pakistan. For instance, the Karakoram Highway, a major road connecting China’s Xinjiang region with Pakistan, has been upgraded with Chinese investment. Similarly, the Lahore Orange Line Metro Train project, a rapid transit system in Lahore, is being developed with Chinese assistance.

The Western route opened up the backward districts of Balochistan and Southern KP and integrated them with the national markets. The communities living along the route are able to produce and sell their mining, livestock and poultry, horticulture, fisheries output to a much larger segment of consumers.

Industrial Zones:

China is establishing special economic zones (SEZs) in Pakistan to promote industrial development and attract foreign investment. One such example is the Rashakai SEZ in Khyber Pakhtunkhwa province, which is being developed with Chinese investment to facilitate industries and create job opportunities.

5. Fiber Optic Cable:

China has invested in the construction of a fiber optic cable project between Pakistan and China, enhancing communication and connectivity between the two countries. This project aims to improve internet connectivity and facilitate data transfer.

Agriculture and Livestock: Chinese companies have shown interest in investing in Pakistan’s agriculture and livestock sectors. This includes projects related to modern farming techniques, livestock breeding, and agricultural research and development.

Under the BRI, China is spending over eight times more in Pakistan than the United States is, according to AidData’s research. The U.S. spends on soft infrastructure in Pakistan such as education, governance, and law and order capacity building, while China spends on hard infrastructure there.

Debunking myths around Chinese investment in Pakistan and its impact on sovereignty is essential to have a more nuanced understanding of the situation. Chinese investment in Pakistan is primarily channeled through the China-Pakistan Economic Corridor (CPEC), a flagship project under China’s Belt and Road Initiative (BRI). Here are some key points to consider when discussing this topic:

Voluntary Participation: Pakistan voluntarily entered into agreements with China to undertake CPEC projects. It was not imposed upon Pakistan by China. The Pakistani government saw potential economic benefits from this partnership and chose to engage with China.

Economic Benefits: CPEC is expected to bring significant economic benefits to Pakistan. It includes infrastructure development, energy projects, and industrial zones, which can enhance economic growth and create jobs. These projects can help alleviate poverty and improve the living standards of Pakistanis.

data shows even more promising results, with CPEC generating around 800,000 jobs in the next 15 years.

There are a number of international and regional geopolitical realities which are the cause of criticism and opposition to CPEC. There is competition for influence between U.S. and China at one level, and between India and China at another.

Sovereign Decision-Making:

Pakistan retains sovereignty over its decisions regarding CPEC. While China is a major partner, Pakistan maintains control over project approval, implementation, and oversight. It is essential to distinguish between debt and equity-based projects, as equity investments do not lead to debt dependency.

Debt Sustainability:

Concerns about Pakistan’s debt sustainability due to CPEC have been raised. It’s crucial to differentiate between concessional loans and commercial loans. Concessional loans have lower interest rates and favorable terms, while commercial loans may be more burdensome. Pakistan must ensure responsible borrowing and prudent financial management.

Only approximately half of $ 45 billion committed originally for CPEC would be utilized for these projects. Pakistan’s liability is therefore at present limited to this $ 23‐25 billion only. Many other projects are at feasibility stage, discussion or negotiation stage between the two governments or on hold.

No amount has either been committed or disbursed for these projects and the liability of Pakistan has not yet arisen.

Out of total commitment of $ 50 billion, seventy percent or $ 35 billion are coming to Pakistan in form of Foreign Direct Investment. The Chinese companies are following the established IPP policy of the Government which is applicable to all domestic and foreign investors under which they are allowed 17 percent return on equity in US dollar terms.

Infrastructure projects are financed by long term concessional loans averaging interest rate of 2 percent and grants.

Transparency: Critics argue that CPEC agreements lack transparency. Pakistan should strive for greater transparency and accountability in the implementation of CPEC projects to address these concerns.

Local Benefits: Ensuring that local ‘communities’ benefit from CPEC is vital. Pakistan should prioritize the welfare of its citizens and local businesses by providing them with opportunities and jobs arising from these investments.

Environmental Impact: Critics also point to potential environmental issues. Pakistan should incorporate sustainable practices in CPEC projects to minimize negative environmental impacts.

The Chinese have voiced concerns regarding negative CPEC talk, security and red tape.

Under its One Belt One Road Initiative announced in 2013, China is planning to invest more than $1 trillion in 60 countries all over the world to establish six different corridors.

The receptivity in other countries to this proposal has been anything but enthusiastic; however, some Chinese friends are puzzled by the skeptical and negative reactions from certain quarters in Pakistan expressed in the media, particularly on social media.

This comes to them as a surprise because of the long uninterrupted record of strong bilateral relations between the two countries that were not even affected by changes in political leadership in either country. CPEC is the first project of its kind to foster economic cooperation on a massive scale for building large infrastructural projects in Pakistan.

Although realizing that there are some external forces hostile to this initiative, Chinese analysts and participants are concerned about what they see as the misrepresentation of facts by many Pakistanis. It is not obvious to them as to what purpose is served by raising doubts and fears about CPEC in the minds of the Pakistani population.

The aspersions being cast on the motives of the Chinese, such as the analogy with the East India Company or Pakistan becoming a satellite of China, are very unnerving: external detractors of CPEC pick up these reports and after bundling them as ‘risks’ of CPEC to Pakistan, disseminate them widely.

The Chinese argue that the IPPs have been a policy instrument for investment in Pakistan’s energy sector for a very long time. When the country was facing serious energy shortages no one else came to Pakistan’s rescue and invested in the sector. Now that

China has come forward with a planned investment of $35 billion or 70 per cent of the total CPEC allocation under the same policy, questions are being raised.

Had it involved extraction of natural resources from Pakistan for the benefit of the Chinese, this criticism would have been justifiable. On the contrary, the benefits of this investment would be exclusively appropriated by Pakistan’s industries and households that would no longer face load‐shedding while the country would record a 2pc annual rise in GDP growth.

Chinese state‐owned companies, designated by the Chinese government based on their expertise and experience, are executing the projects with loans provided by government‐ owned banks on concessional terms both in tenor and pricing. In several projects, Chinese and Pakistani companies have entered into joint ventures.

The repatriation of profits and debt‐servicing in foreign exchange arising out of these obligations would become possible after an increase in the volume of exports as a result of the Chinese‐Pakistani joint ventures relocating their industries to the Gwadar Free Economic Zone and the nine industrial zones to be established under CPEC.